Can I Write Off Entertainment Expenses 2024. Entertainment expenses, in general, are no longer deductible as of the tax cuts and jobs act (tcja). The amount you incurred for the expenses.

Drug enforcement administration is moving toward reclassifying marijuana as a less dangerous drug. Rules for business meal deductions.

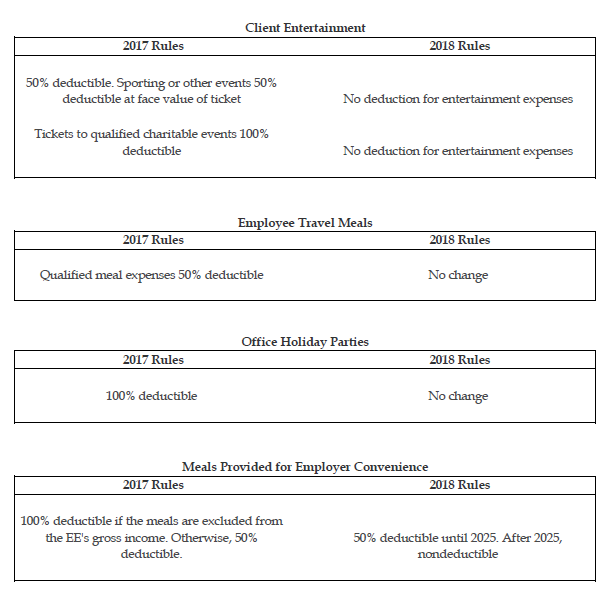

Your Meals And Events Now Can Be Eligible For Either 100% Or 50% Deductibility.

You can't write off the possibility of the next move being a hike rather than a cut, but we think it's a.

Any Misclassification Between Meals And Entertainment.

I had everything anchored to my personal email in the.

Most Entertainment Expenses Are No Longer Deductible As Business Expenses But Meal.

Images References :

Source: www.beany.com

Source: www.beany.com

A guide to entertainment expenses Beany Australia Online Accounting, The cost of transportation to and from the meal isn't part of the cost of a business meal. Washington (ap) — the u.s.

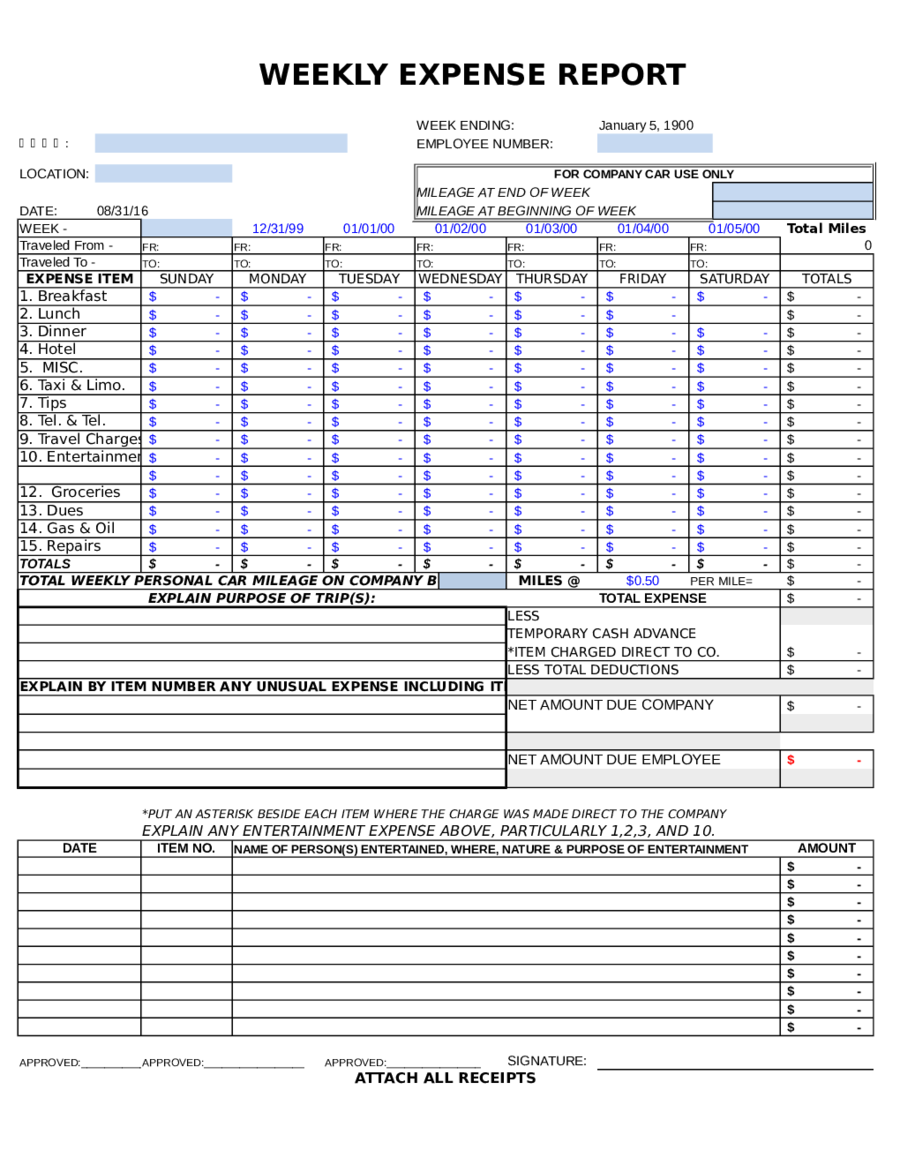

Source: handypdf.com

Source: handypdf.com

2024 Expense Report Form Fillable, Printable PDF & Forms Handypdf, (50% of their cost can be deducted.) What got cut was client entertainment expenses — think concert tickets, or a round of golf.

Source: www.plantemoran.com

Source: www.plantemoran.com

Expanded meals and entertainment expense rules allow for increased, Washington (ap) — the u.s. The irs released additional regulations in.

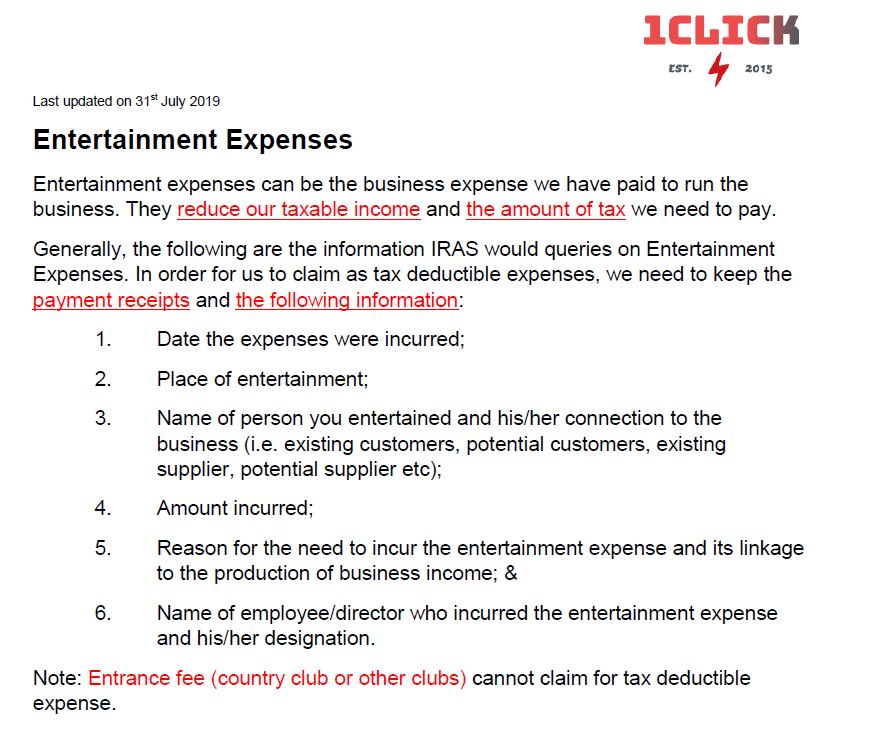

Source: 1clickservices.com

Source: 1clickservices.com

Tax Updates 1Click Helping StartUp Succeed In Business, Due to the consolidated appropriations act signed into law in december 2020, the deductibility of meals is different from what it used to be. Why people hide their debt, its dangers, and 5 steps to recovery.

Source: www.dynamicpoint.com

Source: www.dynamicpoint.com

Tips To Cut Employee Travel & Entertainment Expenses, Some things are 100 percent deductible, some are 50 percent, and a few are nondeductible. The amount you incurred for the expenses.

Source: www.slideteam.net

Source: www.slideteam.net

Entertainment Expenses Employees Ppt Powerpoint Presentation Summary, You can't write off the possibility of the next move being a hike rather than a cut, but we think it's a. (50% of their cost can be deducted.)

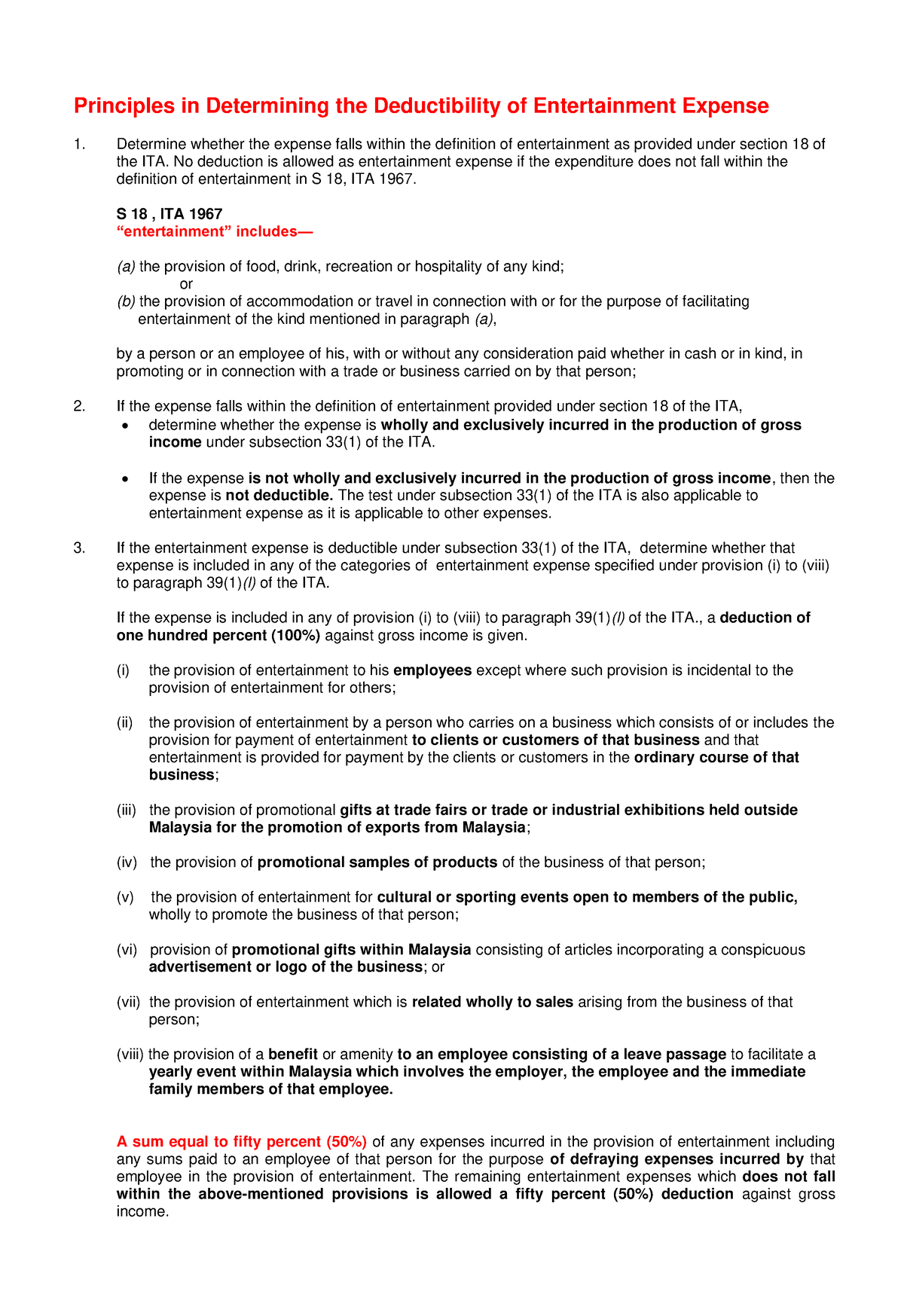

Source: www.studocu.com

Source: www.studocu.com

Entertainment Expenses Principles in Determining the Deductibility of, Most entertainment expenses are no longer deductible as business expenses but meal. The cost of the meal can include taxes and tips.

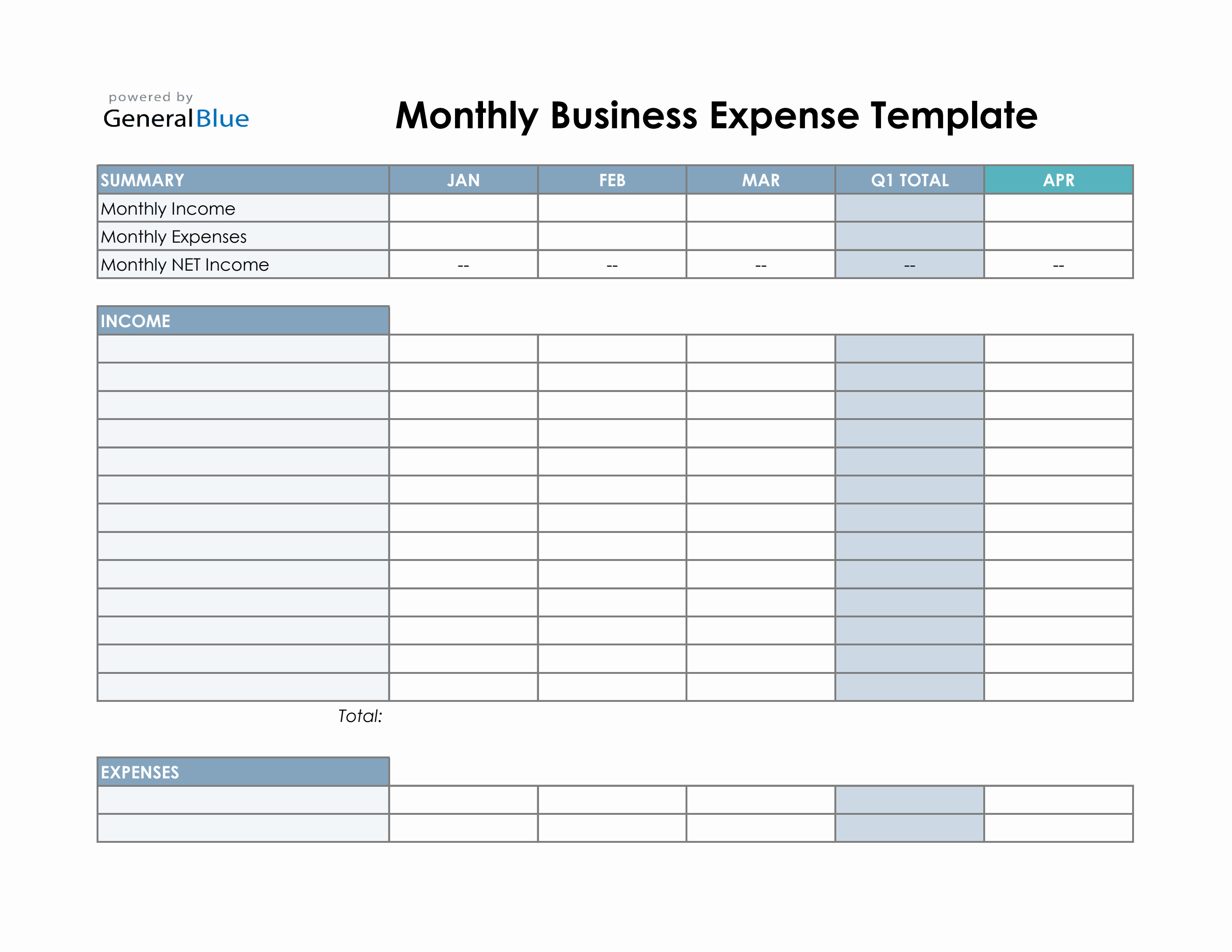

Source: stackby.com

Source: stackby.com

Free Excel Spreadsheet for Business Expenses (2024) Stackby, In spite of these new restrictions, there are still a few entertainment expenses that you can fully deduct from your taxes. It all depends on the.

Source: kisspiqr.blogspot.com

Source: kisspiqr.blogspot.com

Entertainment Expenses Tax Deductible Malaysia What are entertainment, Drug enforcement administration is moving toward reclassifying marijuana as a less dangerous drug. This article is tax professional approved.

Source: knowdemia.com

Source: knowdemia.com

How to Write Off Business Expenses Knowdemia, It all depends on the. The irs released additional regulations in.

2023 / 2024 Meals And Entertainment Allowable Tax Deductions.

The cost of transportation to and from the meal isn't part of the cost of a business meal.

The Amount Of Each Separate Expense;

Most entertainment expenses are no longer deductible as business expenses but meal.