1099 Download 2024. Be aware that the update in the microsoft download center. Candidates can download the scorecard by following the steps given below.

$60 per form if you file within 30 days after the due date. Tax surprise coming to many in january 2024:

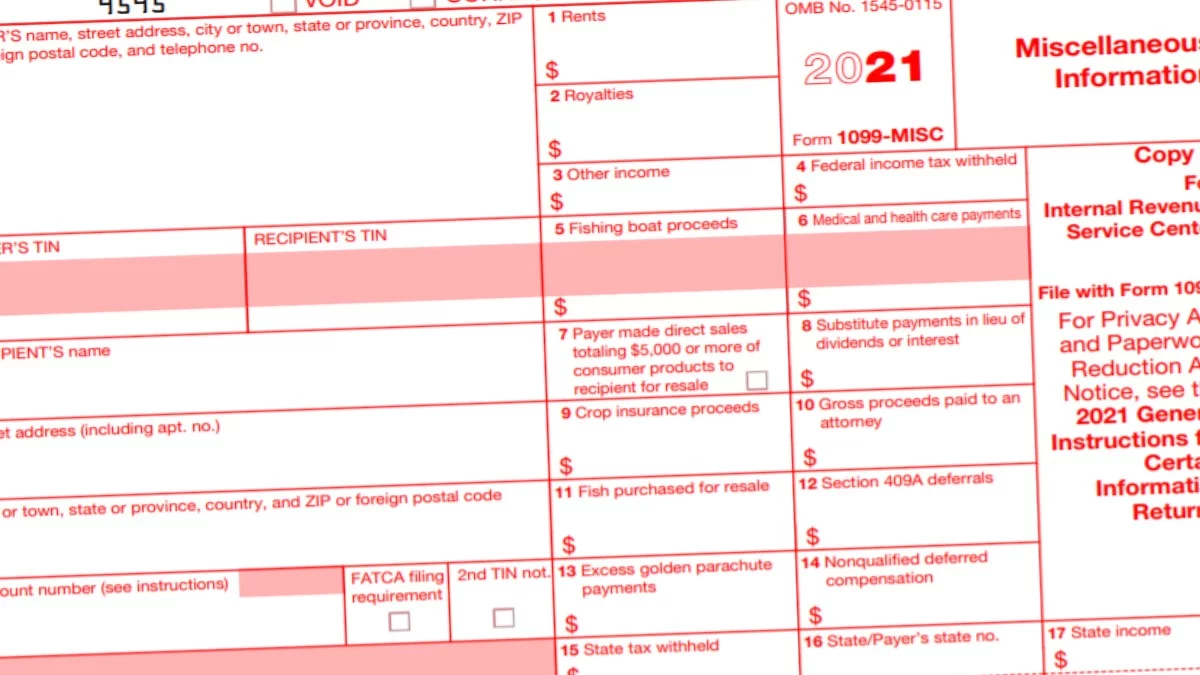

The Irs Has Announced An Important Change To Form 1099 Reporting This Year.

This is an early release draft of the form, as well as its instructions, which the irs is.

$120 Per Form If Over 30 Days Late But Before Aug 2.

Click settings next to “log out.” click statements and taxes near the top of the page.

The Form 1099 Late Filing Penalty Is As Follows Based On How Late You File:

Images References :

Source: amabelqmadelene.pages.dev

Source: amabelqmadelene.pages.dev

1099 Form Download 2024 Vivie Jocelyne, How firms are preparing for new 1099 reporting rule deluge. Click settings next to “log out.” click statements and taxes near the top of the page.

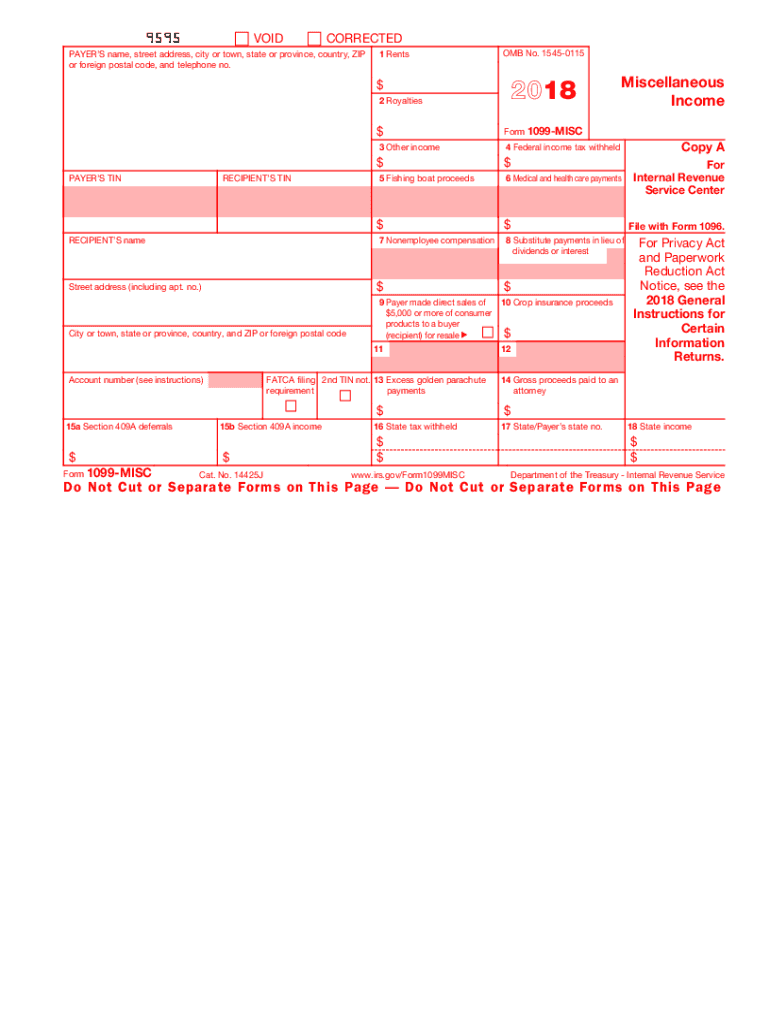

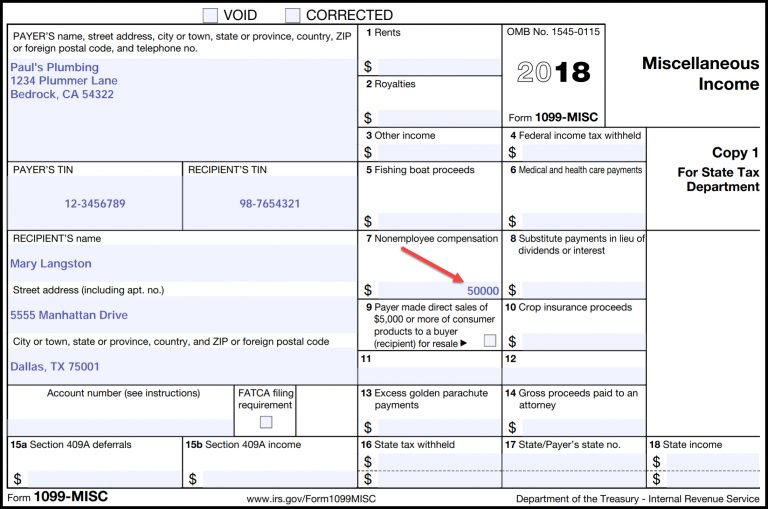

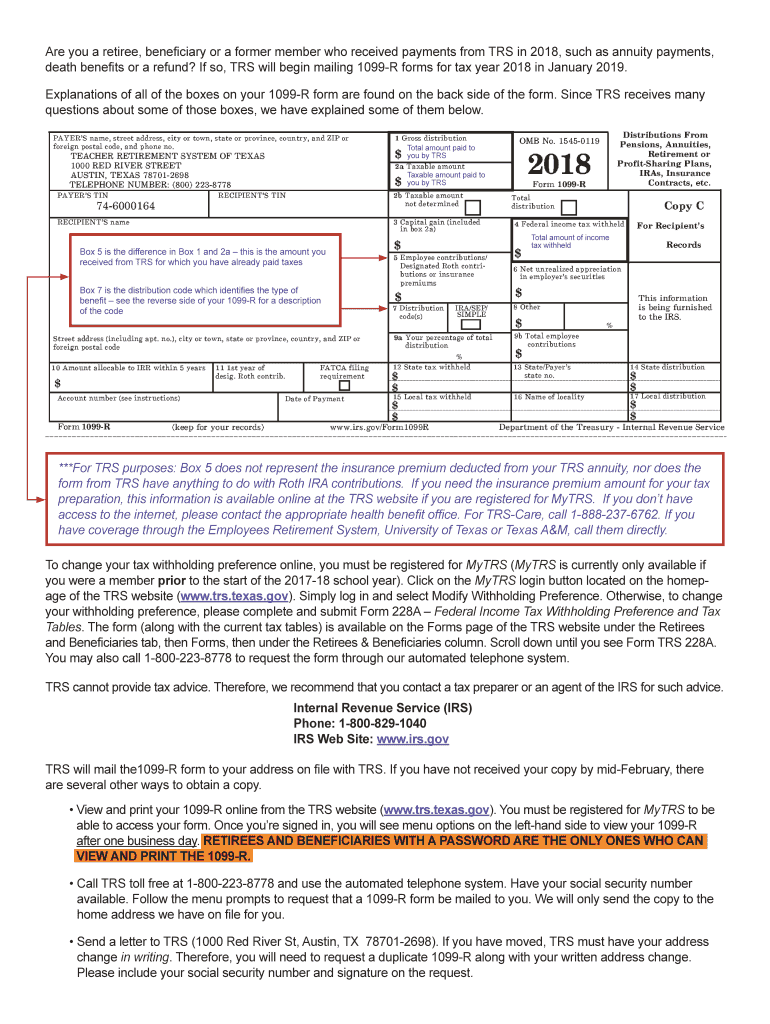

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. If you qualify for the form, shopify will email you a copy by january 31.

Source: www.taxuni.com

Source: www.taxuni.com

1099MISC Form 2023 2024, Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use in advance of the opening of. Major upcoming changes to 1099 filing requirements make it more.

Source: printableformsfree.com

Source: printableformsfree.com

1099 Form Fillable Pdf Printable Forms Free Online, This article describes update 5002388 for microsoft office 2016 that was released on april 2, 2024. Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg) Source: printableformsfree.com

Source: printableformsfree.com

Types Of 1099 Form 2023 Printable Forms Free Online, Electronic filing requirements for 1099 in 2024. Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

Source: www.hourly.io

Source: www.hourly.io

What You Need to Know about Form 1099NEC Hourly, Inc., Tax surprise coming to many in january 2024: On the homepage, locate and.

Source: negozee.com

Source: negozee.com

IRS cambia el requisito 1099K hasta 2024 negozee, The irs has announced an important change to form 1099 reporting this year. $60 per form if you file within 30 days after the due date.

Source: 4freeprintable.com

Source: 4freeprintable.com

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099, $120 per form if over 30 days late but before aug 2. On the homepage, locate and.

Source: www.dochub.com

Source: www.dochub.com

Texas 1099 form Fill out & sign online DocHub, Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use in advance of the opening of. $120 per form if over 30 days late but before aug 2.

Source: 1099-g-form.pdffiller.com

Source: 1099-g-form.pdffiller.com

20222024 Form IRS 1099G Fill Online, Printable, Fillable, Blank, Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use in advance of the opening of. How firms are preparing for new 1099 reporting rule deluge.

If You Qualify For The Form, Shopify Will Email You A Copy By January 31.

Tax surprise coming to many in january 2024:

Visit The Official Website Of Nta Nittt At Nittt.nta.ac.in.

Payers must provide 1099 recipients with their copy of the form.